Introduction to Cardiology Market in India – Price Cap on Stents in India

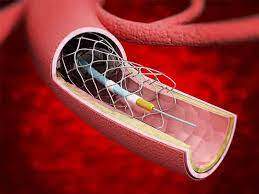

Price Cap on Stents in India plays a major role for Manufacturers who are looking to import into India. The Indian Cardiology market is expected to Grow Rapidly in the next few years according to various reports. The Cardiology Market in Medical Devices Drugs and surgeries has been growing due to the improved quality in its operation standards. The Rise in the aging population and their lifestyle is attracting the manufacturers to invest across the country. According to the World Health Organisation, about 35% of deaths all across the globe is due to cardiovascular disorder. Surgical and Interventional Cardiology devices have reduced complications and increased the recovery rates. Hence there is an urgent demand for interventional products such as stents, catheters, coils, cardiac monitoring devices and imaging devices. Hence there is a continuous requirement for advancement in Interventional Cardiology Devices. This article deals with the various changes in the Cardiology Market in India and the Price Cap on Stents in India.

Pricing Fixed by the Indian Government

Stringent Price Caps on the Stent Device in India has changed the Market Dynamics in the last few years. Improved availability of affordable stents has increased the usage of the stents by about 40%. On 12th May, 2020, The National Pharmaceutical Pricing Authority (NPPA) revised the cost of Bare Metal Stent (BMS) to Rs 8,261 and the Drug Eluting Stents (DES) to Rs 30,080. The manufacturers who do not comply with the pricing will be liable to deposit the overcharges amount along with interest of the Drugs (Prices Control) Order, 2013 read with Essential Commodities Act, 1955.

MNC Recommendations

National Pharmaceutical Pricing Authority (NPPA) held a stakeholders’ meeting with multinational companies, domestic manufacturers, importers and distributors as well as civil society representatives, for their views and will decide whether the prices of cardiac stents should be revised or not and the decision is pending, This meeting with multinational stent makers the regulators agreed they would consider sub-categories for drug-eluting stents only if they could prove superiority of their next-generation stents. Government has also appointed committees to assess the findings. Multinational stent makers were pushing for better prices for their next-generation stents. The Rise in Aging population and their Lifestyle will be giving more scope for the manufacturers to invest in Coronary Stent production and marketing across the country. This shows there is enormous potential for SME to introduce their stents into the Indian market.

Indian Manufacturer Recommendations

The government’ decision to bring down the prices of bare metal stents and drug eluting ones has brought in mixed reactions from the medical devices manufacturers and the dealers and other representatives. This decision by the NPPA has been welcomed by the Indian Manufacturers of Medical Devices and Indian Stent Manufacturers Association (ISMA). The manufacturers also want the price to be kept constant or NPPA to increase it as and when there is a change in inflation rate. Manufacturers have also assured the government of their continued support to hospitals on high level efficiency of product supply across India. Due to this Price cap on coronary stents, the domestic stent maker’s shares have risen. It shows an approximate 5% shift in favor of domestic manufacturers.

Observations made by the Authority

Medical devices are regulated for quality, as well as for their pricing. All medical devices that are marketed in India are controlled and the prices are regulated by the Drug (Price Control) order 2013 (DPCO). Coronary stents, Drug eluting stents, condoms and intra-uterine devices are some of the Devices listed by the DPCO and their ceiling price are fixed by the National Pharmaceutical Pricing Authority (NPPA), all the non-scheduled medical devices have to abide by a restriction whereby their maximum retail price cannot increase by more than 10 per cent in any given 12-month period. Hospitals are now under the legal obligation to bill cardiac stents separately, from the operation procedure or package charges. In NLEM last year, the Union Health Ministry included Stents pricing based on a petition put on public interest, demanding to bring the prices under control. All medicines notified as schedule-I drugs should keep their prices under control. During the past 5 years with cardiovascular diseases on the rise, the number of angioplasties being performed has doubled in the country.

Conclusion

The growing medical industry, along with the prevalence of various cardiovascular ailments, is one of the key factors which is affecting the growth factors of the market. Price caps on cardiac stents imposed by the government have improved its accessibility and thereby many patients are getting treated at affordable cost. With the available data and market information and statistics, NPPA took the decision to place cardiac stents being an essential drug, under Schedule I of DPCO (Drug Price Control Orders), a part of NLEM (National List of Essential Medicines) and also decided to continue and keep it under price regulation for the benefit of the HealthCare in India.

How Can Morulaa Help?

Morulaa HealthTech as successful regulatory and Import Consultants have delivered high levels of professionalism towards our clients. To understand how the revised Coronary Stent Pricing will help your business in India, contact us to know more.

Leave a reply

You must be logged in to post a comment.